Buying things we don't need. It makes us poorer, so we have to work more just to break even. Often we'd be better off not buying.

The biggest household expense, other than our house, is health / medical costs.

Why? Australia has "one of the best public health systems on the planet" that's already paid for; so you may as well use that. (Note: This may be a different story in the USA and other countries). The exception is if you're over 30 and a high income earner.

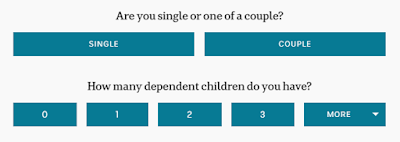

Despite all these punitive measures, it still may not be worth it. Try this interactive calculator to see the pros and cons for your situation.

"They can do math and they've worked it out", explains panelist Todd Sampson. The insurance companies "don't want you to use too much. They work off the 30% rule. So if you pay $1000 for your fee you get roughly $300 back a year - and $700 goes straight to profit."

PS. Make up your own mind about your situation, but do think about whether you need it and what the reasons are. According to stats, it's the second biggest single cost after housing. You may also want to see my post on how to save on housing.

The biggest household expense, other than our house, is health / medical costs.

Is private health insurance worth it?

Finance expert Scott Pape (The Barefoot Investor) says in many cases the answer is no. He reckons if you're under 31, or earn under $90,000 ($180,000 for couples) you're probably better off without it.Why? Australia has "one of the best public health systems on the planet" that's already paid for; so you may as well use that. (Note: This may be a different story in the USA and other countries). The exception is if you're over 30 and a high income earner.

What's wage got to do with it?

Health insurance is one product the government punishes you for not buying. If you're a high income earner you'll be taxed more if you don't buy some. If you decide to buy some later in life (later than 30) then you'll pay an extra fee on top of normal premiums - whatever your income.Despite all these punitive measures, it still may not be worth it. Try this interactive calculator to see the pros and cons for your situation.

From an advertising perspective

ABC's comedy/advertising show Gruen did a health episode. Most of the chat was about the psychology of how companies advertise - particularly to young people who generally don't need the product. "In the past year 250,000 people have ditched health insurance. The majority of them are under 34", states host Wil Anderson."They can do math and they've worked it out", explains panelist Todd Sampson. The insurance companies "don't want you to use too much. They work off the 30% rule. So if you pay $1000 for your fee you get roughly $300 back a year - and $700 goes straight to profit."

PS. Make up your own mind about your situation, but do think about whether you need it and what the reasons are. According to stats, it's the second biggest single cost after housing. You may also want to see my post on how to save on housing.

Comments

Post a Comment